Minnesota Work

Neighbors for More Neighbors volunteers are hard at work at the Minnesota legislature! We are a part of a number of coalitions supporting a range of legislative efforts around housing.

Neighbors for More Neighbors’ key focus areas are:

Increasing the supply of accessible and affordable housing statewide through the Yes to Homes coalition.

Protecting renters and promoting stable homes through Just Cause Eviction Protections.

Protecting renters who receive housing assistance and eliminating source of income discrimination through Source of Income Protections.

Creating a fairer tax system and encouraging development through a Land Value Tax.

To meet these goals, we are tracking and supporting bills to advance these policy priorities statewide.

Our Minnesota Focus Areas

Yes To Homes Coalition

Who We Are

The Yes to Homes Coalition is a bipartisan group of leaders and organizations from across Minnesota, including housing advocates, community organizers, home builders, businesses, labor, environmental, and faith-based groups, and transportation advocates.

Why Yes to Homes

Every Minnesotan belongs in a home that is safe and affordable, yet this is increasingly out of reach as increased competition and too few homes drives up prices. Research shows Minnesota needs more than 100,000 new homes to meet the needs of all our neighbors. Across Minnesota, restrictive rules about what kinds of homes can be built where are preventing us from having the homes we need, with sizes and prices that allow everyone to find a home they can afford.

Together, Yes to Homes advances proven, practical housing policies that help communities create more homes and expand opportunity statewide.

Our Solutions

To meet this need, an all-hands-on-deck approach is required. The Yes to Homes coalition is a broad, bipartisan movement with concrete solutions that will jumpstart the production of the kinds of homes Minnesotans want and need, but can’t currently find. Allowing more homes of different types and sizes will increase affordability, allow families to stay in Minnesota, improve local economies, reduce urban sprawl, and make home a reality for more people.

-

Allowing More Starter Homes in Minnesota

Legalizing “Missing Middle” Homes

Allowing More Homes Near Frequent Destinations, like workplaces, stores, and commercial districts.

Removing Residential Parking Mandates

Streamlining housing approvals to help local governments get new homes built.

Reversing the effects of racial and economic exclusionary zoning.

Supporting location efficiency, a crucial strategy to reduce climate impact and improve health and economic outcomes.

Ensuring home construction is not slowed down or subtly banned through overly restrictive city rules and regulations.

Just Cause Eviction Protections

What is it?

Just Cause Eviction Protection requires landlords to have a valid reason to end a tenancy or refuse to renew a lease. This means tenants can't be evicted or forced out simply because their lease is ending, instead, landlords must provide "just cause."

These just cause reasons include nonpayment of rent, repeatedly paying rent late, breaking the lease after receiving notice, the landlord or their family needing to live in the unit, major renovations that make the unit uninhabitable, or converting the property to condos or non-residential use. Additionally, just cause protections require landlords to provide a written notice explaining the reason for lease termination.

Why is it Important?

From rural Minnesota to the suburbs and the cities, all Minnesotans deserve to know why they are being evicted and have a reasonable amount of time to relocate. Just Cause is a common-sense policy that benefits constituents from all political parties.

If you were told you had only 2 weeks to leave your home, your first question might be “Why?” and your second thought might be “How can I find new housing in such a short amount of time?” Just Cause is a policy that ensures that the “why” is answered, and that sufficient time is allowed to prevent families from ending up on the street.

A statewide Just Cause policy will lower unnecessary evictions and lease nonrenewals, and help Minnesotans thrive. Like TOPA, Just Cause has already shown to work in Minnesota. Residents across the state living in manufactured housing, renters in properties that receive federal low-income housing tax credits, and all renters in Brooklyn Center already benefit from Just Cause protections. In Brooklyn Center, research shows that the policy successfully kept residents housed by decreasing evictions.

Source of Income Protections

What is it?

Source of income (SOI) discrimination occurs when a landlord refuses to rent to a housing applicant because of their form of income: housing assistance. This assistance can take a variety of forms, such as Bridges, emergency rental assistance, and Section 8 (Housing Choice Voucher) programs. Source of income protection would ensure that Minnesotans receiving rental assistance have access to housing on the same basis as those without.

Why is it Important?

Housing assistance is a valuable tool to help families find affordable housing and remain stably housed. Eligible families and individuals can wait years to qualify for housing assistance, then years more on waiting lists to receive it. If property owners are allowed to discriminate against people who use rental assistance to pay rent, then under-resourced families are denied the opportunity for a home. And, not only does this assistance help renters, when used, it can be guaranteed income for landlords.

Research bears out that in jurisdictions with legal SOI protections, families have greater success finding housing, and housing authorities have higher voucher utilization rates. Such laws prevent homelessness, deconcentrate poverty, and expand choice.

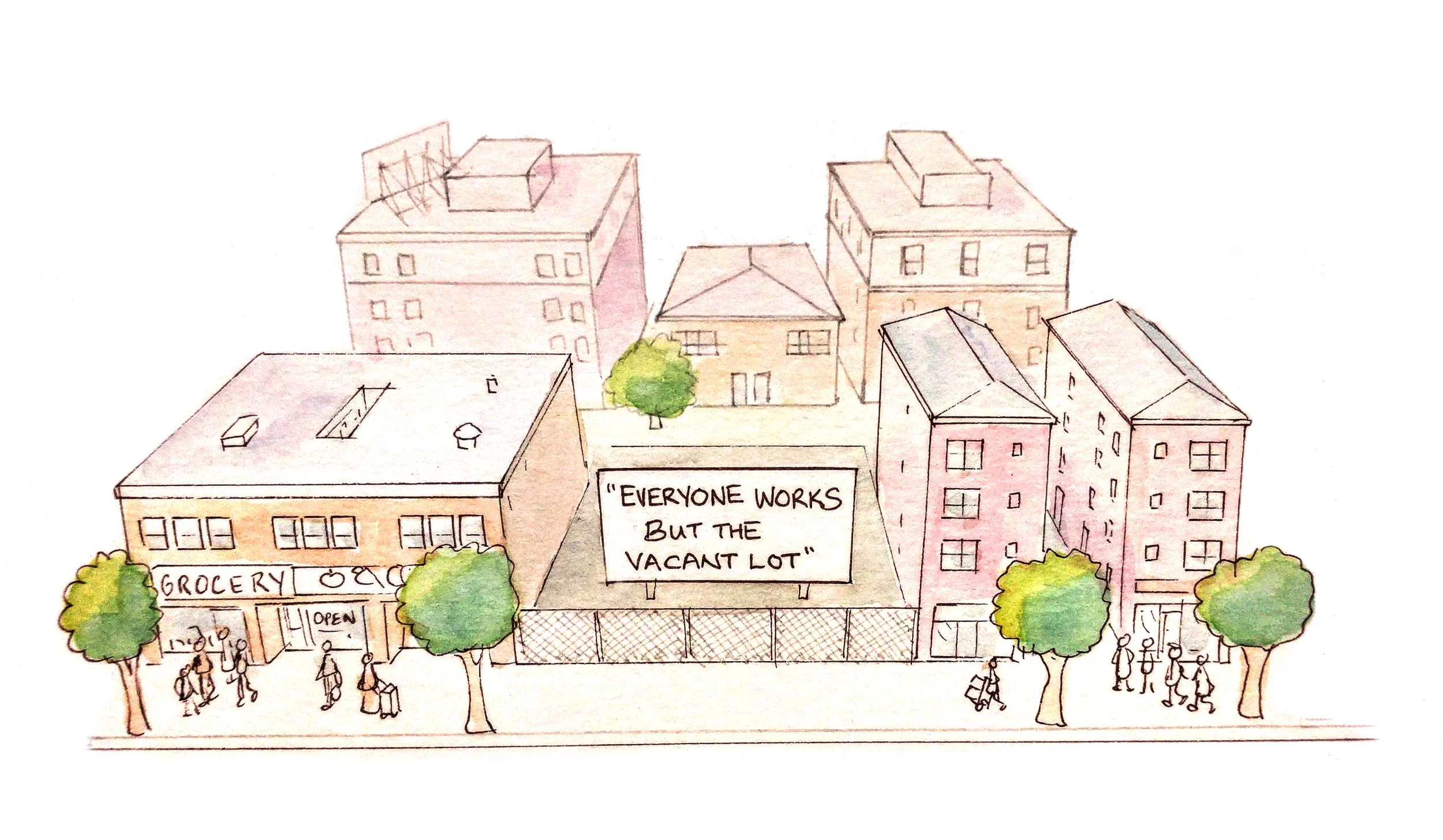

Allow Municipal Land Value Tax

What is it?

Minnesotans across the state currently pay property tax on both the land their homes sit on and the homes themselves. Homeowners and renters pay taxes on the place they live, while developers and landowners pay much less to hold onto vacant lots until the price rises to meet their desired profit. This property tax system incentivizes speculation rather than building new homes or businesses.

A land value tax (LVT) is a different approach to property tax. Rather than taxing buildings or improvements to a piece of land, the tax is primarily on the land itself. This doesn’t change how much a city raises in property tax, just how it is calculated for the owners.

Why is it Important?

Land value taxes remove the incentive to hold onto empty lots, encouraging landowners to build homes or businesses on the vacant land or sell it to someone who will. This tax structure change promotes thriving communities and discourages real estate speculation.

A land value tax policy would:

Allow towns and cities throughout Minnesota to have more options on how to tax properties, including implementing a land value tax on all or part of the city

Discourage landowners and real estate investors from holding vacant land or empty parking lots for speculative value.

Make homes more affordable by encouraging construction of new homes and reducing the inflationary pressures of land speculation.

Our vision is a Minnesota where we recognize that the value of our land lies in the community around it. By legalizing land value taxes, we can encourage redevelopment that supports our communities without burdening our neighbors with new taxes.